CORPORATE ACTIONS

DEFINATION:

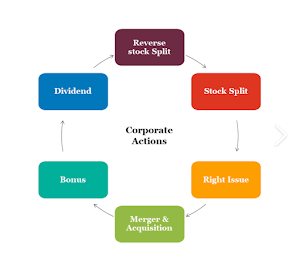

Corporate actions are events initiated by a publicly traded company that can impact its shareholders, financial structure, and overall market position. These actions are often significant events that may affect the value of securities, ownership structure, or investor rights. Corporate actions can be categorized into various types based on their nature and impact.

Corporate actions can be classified into three main categories based on the level of shareholder participation: mandatory, voluntary, and mandatory with a voluntary component.

Mandatory Corporate Actions:

Definition: These are corporate actions that shareholders are required to participate in, and their consent is not sought.

Stock splits: Shareholders receive additional shares automatically based on the predetermined ratio.

Reverse stock splits: Shareholders have their shares consolidated, and the number of shares is reduced, but the value of each share increases proportionally.

Mandatory acquisitions: In certain mergers or acquisitions, shareholders may be required to exchange their shares for cash, stock, or a combination of both.

Voluntary Corporate Actions:

Definition: Shareholders have the choice to participate in these corporate actions, and their consent is actively sought.

Examples:

Tender offers: Shareholders are invited to submit their shares for purchase at a specified price. It is up to each shareholder to decide whether or not to participate.

Rights issues: Existing shareholders are given the opportunity to purchase additional shares at a discounted price. Shareholders can choose whether or not to exercise these rights.

Stock buybacks: The company offers to repurchase shares from its shareholders, and shareholders can decide whether or not to sell their shares back to the company.

Mandatory with Voluntary Corporate Actions:

Definition: These are corporate actions that have both mandatory and voluntary components. Shareholders are required to take a certain action, but they may also have the option to make additional choices.

Examples:

Dividends: Receiving dividends is typically mandatory for shareholders. However, if the company offers a dividend reinvestment plan (DRIP), shareholders may have the option to reinvest their dividends in additional shares.

Bonus issues: Shareholders receive additional shares as a bonus, which is a mandatory action. However, they may also have the option to sell these additional shares if they choose.

Understanding the nature of corporate actions is crucial for investors, as these events can have implications for their investment portfolios. Companies are required to communicate these actions to shareholders through official channels, such as press releases, regulatory filings, and direct communication. Shareholders are encouraged to stay informed and carefully consider their options, especially in voluntary or partially voluntary corporate actions where their decisions can impact their investment positions.

Comments

Post a Comment