Job opportunities in Investment banking Operations

INTRODUCTION:

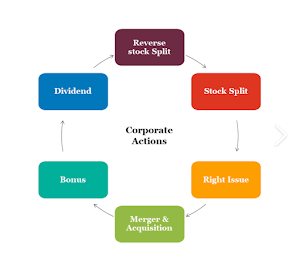

Investment banking operations encompass a wide range of financial activities, including mergers and acquisitions, underwriting securities, advisory services, and managing assets. These operations play a crucial role in facilitating capital raising and corporate transactions for businesses. The scope extends to financial analysis, risk management, and market research, making investment banking a key player in the global financial landscape.

AML (Anti-Money Laundering) Analyst:

AML analysts focus on identifying and preventing money laundering activities, ensuring compliance with regulations, and conducting thorough due diligence on clients.

Compliance Officer:

Compliance officers are responsible for ensuring that the bank adheres to regulatory requirements and internal policies, managing risks associated with regulatory compliance.

Risk Analyst:

Risk analysts assess and manage financial risks, including credit risk, market risk, and operational risk, to safeguard the bank's interests.

Operations Analyst:

Operations analysts oversee the day-to-day operational aspects, including trade settlements, reconciliations, and process improvement within the investment banking framework.

Quantitative Analyst:

Quant analysts use mathematical models and statistical techniques to analyze financial data, providing insights for investment decisions and risk management.

Asset Management Analyst:

Professionals in asset management services handle the management of investment portfolios, making strategic decisions to optimize returns for clients.

Portfolio manager:

Oversee investment portfolios and make strategic decisions. Develop and implement investment strategies based on market analysis. Monitor portfolio performance and risk management.

Client Relationship Manager:

Relationship managers build and maintain relationships with clients, understanding their financial needs and coordinating the delivery of investment banking services.

Private Equity Analyst:

Private equity analysts focus on evaluating and executing investment opportunities in private companies, often working on mergers, acquisitions, and investments.

Investment banking operations are diverse and includes different hierarchy:

Analyst Positions:

Financial analysts play a crucial role in conducting market research, financial modeling, and due diligence.

Associate Positions:

Associates are responsible for managing relationships with clients, assisting in deal execution, and overseeing analysts' work.

Vice President (VP): VPs take on a more strategic role, leading deal teams, managing client relationships, and contributing to business development.

Director/Executive Director: This level involves significant leadership and strategic responsibilities, including shaping business strategies and managing high-level client relationships.

Comments

Post a Comment